The Top 10 Chinese Facebook Apps and Developers

This short powerpoint lists the top 10 Chinese Facebook apps and developers! Two apps crack the top 20 (#18 and #19) in terms of daily active users (DAU) on Facebook, an impressive feat.

NOTE: we failed to include Rekoo and their games in this top list. Rekoo is currently at 646,000 DAU, with its popular Animal Paradise (425,000 DAU) and Sunshine Ranch (197,000 DAU) Games.

Chinese SNS Kaixin001’s Open Platform Experiment

![]() Kaixin001 is experimenting with an open platform, inviting select third party developers to participate. Kaixin001 lags behind RenRen and 51.com, but all Chinese social networks are now slowly but surely moving towards openness. Kaixin001 is immensely popular with Chinese white-collar workers, with a total of 25 million daily active users (86 million registrations).

Kaixin001 is experimenting with an open platform, inviting select third party developers to participate. Kaixin001 lags behind RenRen and 51.com, but all Chinese social networks are now slowly but surely moving towards openness. Kaixin001 is immensely popular with Chinese white-collar workers, with a total of 25 million daily active users (86 million registrations).

It originally rose to prominence by spamming and its viral social games (Parking Wars and Happy Farm). At its peak Kaixin001’s Happy Farm had 15 million daily active users and still has over 10 million today, according to Hans Tung, a partner at Qinming Venture, which invested in Kaixin001. Although Kaixin001 since refocused on relationships, games are one of the most lucrative monetization channels for social networks.

Are Social Games a Bubble? Future Growth Lies in Vertical Social Games

The moderator of the Financing for Social Games panel at ChinaJoy challenged panelists, “Is social gaming a fad? If so, let’s wrap this up in the next five minutes. Then we can all go home and start a Groupon clone instead.” Responses were mixed on the future financial fortunes of social game developers, though no one foresaw a collapse.

The moderator of the Financing for Social Games panel at ChinaJoy challenged panelists, “Is social gaming a fad? If so, let’s wrap this up in the next five minutes. Then we can all go home and start a Groupon clone instead.” Responses were mixed on the future financial fortunes of social game developers, though no one foresaw a collapse.

A consensus did emerge that more social games will target niche audiences. Panelist Atul Bagga, Vice President at ThinkEquity, commented, “So far we see horizontal applications, that is games that everybody is playing: your mom, your granny, your niece, your daughter. I think there is a lot room for vertical applications, for the smaller niche, for example, Watercooler’s Kingdoms of Camelot. It does not have huge usage, but the game kicks butt because the ARPU (average revenue per user) is very high.”

Shanda Launches Candy: A Mashup of Twitter, Facebook, and FourSquare

Candy (Tang Guo / 糖果) mixes microblogging, social games, and badges, a mashup of Twitter, Facebook, and FourSquare. While most social networks are scaling back social games to focus on real friends (e.g., Facebook, RenRen, and Kaixin001), Shanda’s Candy embraces games (with a semi-open platform) and nicknames.

Candy (Tang Guo / 糖果) mixes microblogging, social games, and badges, a mashup of Twitter, Facebook, and FourSquare. While most social networks are scaling back social games to focus on real friends (e.g., Facebook, RenRen, and Kaixin001), Shanda’s Candy embraces games (with a semi-open platform) and nicknames.

It’s almost cliché for Chinese internet giants to launch a microblog or social network; nearly all have tried. The challenge for Candy (in Beta) is to gain initial traction and to achieve user retention. The latter could be challenging for such a casual site, there’s a reason the other social networks are moving away from that model.

Candy reflects Shanda’s effort to diversify into casual games. Over 86% of Shanda’s 768 million USD in 2009 revenues came from Massive Multiplayer Online Role Playing Games (MMORPGs), while casual games accounted for just 12% of revenue. As Shanda’s bread-and-butter MMORPGs like Woool and Mir 2 age, it is imperative that the firm finds new hits or market models.

Copying is not the future of social games, unless you’re a Chinese social network

Though copying of both foreign-made and Chinese-made games is rampant in China’s social games industry today, that’s not what will drive the industry forward.

Though copying of both foreign-made and Chinese-made games is rampant in China’s social games industry today, that’s not what will drive the industry forward.

Liu Jian, chief operating officer of Oak Pacific Interactive, owners of the popular RenRen social network, stated, “Copying cannot be the future model for social game developers, unless you’re Tencent.”

That barb, rare at a Chinese conference like the recent ChinaJoy event, prompted a round of applause. The issue of copying is a common one in game industry history, with the likes of Zynga, Electronic Arts, and Activision Blizzard being blasted for it at some point or other.

ChinaJoy: The Show Goes On, Despite Concerns that Hardcore Game Growth is Slowing

Originally posted at VentureBeat

ChinaJoy, China’s equivalent of the Electronic Entertainment Expo (E3), is famous for its thousands of show girls, new title releases, and the flashy sports cars of the top executives behind it all. This glitz not only attracts droves of young men—potential gamers—like moths to a light, but also reflects the rich fortunes of hardcore online games in China.

Change in China’s Social Games Industry: New Entrants, Markets, and Models

China’s social games industry—the players, games, rules, and business models—is evolving at a blistering pace. China’s Top 10 Social Games and Top Social Networks, a new report by BloggerInsight, analyzes the latest changes.

China’s social games industry—the players, games, rules, and business models—is evolving at a blistering pace. China’s Top 10 Social Games and Top Social Networks, a new report by BloggerInsight, analyzes the latest changes.

Only a year ago, social games in China were developed by individuals or a small team on a shoestring budget, destined for RenRen (then Xiaonei) or other Chinese networks. Today, buoyed (and pressured) by investment (primarily foreign), developers have formed serious teams and launch their games in more lucrative markets.

Ministry of Culture to Regulate Online Games in China

Yesterday (June 22nd, 2010) the Ministry of Culture of the People's Republic of China released new regulations on online games, which will come into effect on Aug 1st, 2010. All online and social games will be subject to stricter scrutiny going forward.

Yesterday (June 22nd, 2010) the Ministry of Culture of the People's Republic of China released new regulations on online games, which will come into effect on Aug 1st, 2010. All online and social games will be subject to stricter scrutiny going forward.

The most sweeping change is the requirement of real names and valid ID, which would completely change the anonymous nature of the Chinese internet. The vast majority of gamers and BBS and QQ users use nicknames rather than real names. Networks, portals, and game developers are all likely to balk unless the policy is vigorously enforced.

The other key change is that online platforms are prohibited from selling virtual currency to minors (under 18). Tencent, the Chinese internet giant that caters to teens, had its stock fall about 5% in Hong Kong upon the news, despite issuing a statement that it would not be affected.

Before FarmVille: Origins of The Digital Agricultural Revolution

Farm games are a craze on social networks worldwide, but its origins are mistaken. The story of farm games is a reflection of the young social games industry: rife with copycats, riches, and misunderstandings.

Origins

Most social games are far from revolutionary: farm games pre-date their social network successors by 15 years. SimFarm, released by Maxis in 1993, is the earliest to this author’s knowledge. Harvest Moon, released by Victor Interactive Software in 1996, further popularized the genre. To date, the spread of social games is all about distribution, not original gameplay.

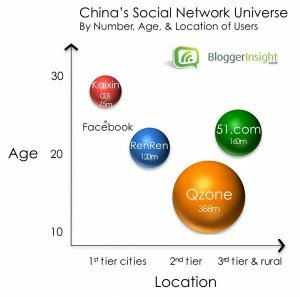

China’s Top 4 Social Networks: RenRen, Kaixin001, Qzone and 51.com

Originally posted at VentureBeat

There is no single dominant network, no Facebook for all of China. The actual Facebook.com is blocked by government censors (Chinese sites all obediently and quickly remove “objectionable” content). No single social network will conquer the China market in the immediate future, least of all a foreign one.

Instead, there is fierce competition between the top four:

- RenRen (formerly Xiaonei) copied the Facebook model: it started with students and has since opened to all.

- Kaixin001 attracted white-collar office workers by focusing on fun, addictive social games.

- Qzone gained young teens and rural users via cross-promotional traffic from QQ Messenger.

- 51.com started strong in lower tier cities, but growth has since slowed.

This post will assess market share, profile the top four, and boldly predict the future.

Pages

Categories

- English

- Game Analysis

- game developers

- Publishers

- Social Networks

- Top Social Games

- Uncategorized

- Virtual Currency

Blogroll

Archive

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

Meta

- Log in

- RSS

- Comments RSS