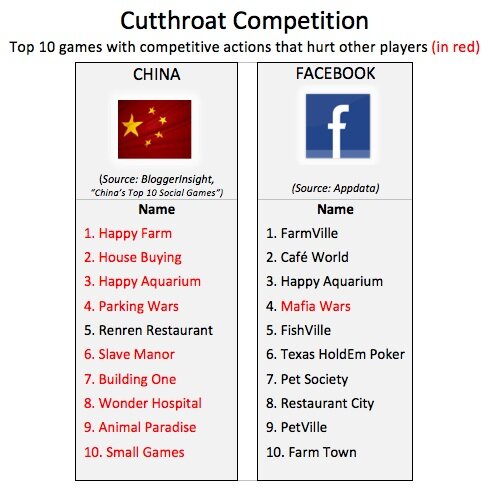

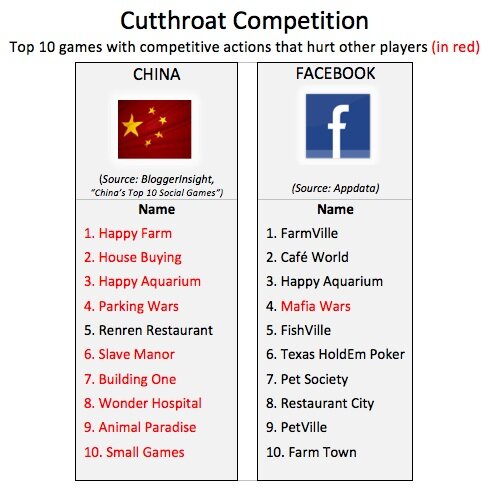

The Chinese government seeks a harmonious society. But itâs Facebookâs social games that are cooperative, while Chinaâs closer resemble the Ultimate Fighting Championships.

9x as Competitive as Facebook?

Of Chinaâs top 10 social games, 9 feature competitive actions that hurt other players (see graphic); the one exception is Renren Restaurant, an exact copy of Playfishâs Restaurant City on Facebook. Of Facebookâs top 10 games, only 1 features competitive actions. Chinese players cherish intense competition.

High-Margin Virtual Goods are Generating Very Real Profits

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The âCopy-to-Chinaâ label grossly underestimates the power and ingenuity of Chinaâs internet ventures.

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The âCopy-to-Chinaâ label grossly underestimates the power and ingenuity of Chinaâs internet ventures.

Identical Western replicas do not work (there is a reason why no large multinational internet business is a leader here). Instead, local companies are innovating to serve the Chinese market better, creating products and services that appeal to the needs of the consumer. This is also true of other Asian markets, and the region is now a global leader in virtual goods. So much so that the businesses in Silicon Valley and elsewhere are starting to take notice.

For the unbelievers, there are enticing examples of the rewards to be had. Internet heavyweight Tencent recorded revenues of USD 1 billion, at a profit margin above 40 per cent, by selling virtual goods across its multiple online platforms for RMB 10 (RMB 1 = approx. USD 0.14) at a time. Home to Chinaâs most popular instant messenger QQ, Q-Zone social network, and related game sites, it is one of a number of domestic internet sites making a very real profit from something âvirtualâ.

Are Chinese More Addicted than Westerners?

The Top 10 Social Games in China (a new report released by BloggerInsight) details the exploding social gaming market in China and analyzes how game companies can compete to succeed.

Parking Wars received a lot of attention for its initial success but has since been outpaced. Happy Farm hit next and still continues its mainstream popularity, now reaching 27m DAU in China and basically matching FarmVilleâs 29m DAU on Facebook. Chinaâs enthusiasm for social games at least matches and arguably exceeds that seen on Facebook.

Chinaâs social games are similar to those on Facebook in terms of themes: the top 10 includes farming, aquarium, pet, and restaurant games. However, further analysis yields some unique characteristics in terms of the developer industry, competitiveness, and popularity.

#1 Happy Farm

Itâs hard to overstate Happy Farmâs popularity. In addition to the real deal, there are countless copycats and countless games have adopted the addictive mechanics.  Chinese versions are more competitive than their Western counterparts: they allow users to steal and add worms and weeds to friendsâ farms.

Â

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The âCopy-to-Chinaâ label grossly underestimates the power and ingenuity of Chinaâs internet ventures.

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The âCopy-to-Chinaâ label grossly underestimates the power and ingenuity of Chinaâs internet ventures.