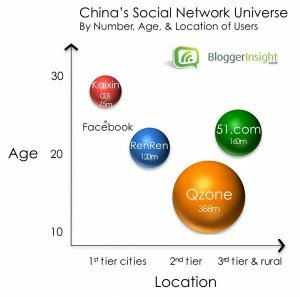

China’s Top 4 Social Networks: RenRen, Kaixin001, Qzone and 51.com

Originally posted at VentureBeat

There is no single dominant network, no Facebook for all of China. The actual Facebook.com is blocked by government censors (Chinese sites all obediently and quickly remove “objectionable” content). No single social network will conquer the China market in the immediate future, least of all a foreign one.

Instead, there is fierce competition between the top four:

- RenRen (formerly Xiaonei) copied the Facebook model: it started with students and has since opened to all.

- Kaixin001 attracted white-collar office workers by focusing on fun, addictive social games.

- Qzone gained young teens and rural users via cross-promotional traffic from QQ Messenger.

- 51.com started strong in lower tier cities, but growth has since slowed.

This post will assess market share, profile the top four, and boldly predict the future.

Responses to “3 Reasons Why Tencent’s Qzone is a Failure”

Benjamin Joffe of +8* posted his complete commentary "Sorting Failure From Success in Social Networking | The Tencent Case" in response to our latest piece "3 Reasons Why Tencent’s Qzone is a Failure." Thanks to Benjamin Joffe for posting this!

Benjamin Joffe of +8* posted his complete commentary "Sorting Failure From Success in Social Networking | The Tencent Case" in response to our latest piece "3 Reasons Why Tencent’s Qzone is a Failure." Thanks to Benjamin Joffe for posting this!

While the overall success of Tencent as a company is pretty obvious, our friends from Blogger Insight took the specific case of Tencent’s SNS properties Qzone, QQ Campus and Xiaoyou to see how they were performing. Their conclusion is that Tencent pretty much failed at SNS. Our take is less conclusive. Read the full piece here.

3 Reasons Why Tencent’s Qzone, the Largest Social Network in China, is a Failure

Qzone, “the largest social network in China,” and Tencent’s other SNS (QQ Campus and Xiaoyou), are failures for three reasons:

- Squandered Opportunity: Chinese internet giant Tencent was enviously positioned to dominate social networking, but blew its chance. QQ Campus failed. Xiaoyou is far behind the competition. Qzone does not reach any new demographics.

- The Site’s Design and Features are Lousy: The Qzone website is an unintuitive eyesore. Its applications are of poor quality and frequently inaccessible.

- Is Qzone Really No. 1? Tencent’s claim of 305 million active users is highly suspect; even its classification as an SNS is questionable. Its competitors are encroaching upon its core user base of young teens.

Does this mean Tencent will soon collapse? Absolutely not.

5 Predictions for China Social Games in 2010

The Chinese social game market is still in its infancy, but growing up fast. The first smash hits, Friends for Sale! Parking Wars, and Happy Farm are just over a year old in China. Here are 5 predictions for 2010:

1. Social Games Displace Web Games

Social games have a superior distribution model for reaching unprecedented demographics, including females and middle-aged users. These users are open to casual gaming, but unlikely to seek it out on 3rd party websites, as required by web games. Social games go viral by using existing services (social networks) and trusted references (friends). Social games are more than a fad.

Moreover, in-game social interaction has only scraped the surface. At the moment, it’s very limited: players can visit a friend’s game and leave a footprint (steal crops, play with pets, decorate a room). Once more games offer synchronous gameplay and allow friends to chat, expect social games to become more popular still. Casual web games don't connect friends in the same way.

As a result, social games enjoy unprecedented numbers of users. In China, Happy Farm has an estimated 23m daily active users across all platforms. On Facebook, FarmVille has blasted past 27m daily active users in only 6 months. Explosive growth will continue in 2010 and web games will be left in the dust.

2. Consolidation of Game Developers

The days of a few friends developing a hit from the dorm room are over. The Facebook market has already seen consolidation on a colossal scale, with huge paydays: Playfish (300m USD merger with EA), Zynga (180m USD funding), RockYou! (70m USD funding), and Playdom (43m USD funding). Production values are rising in China too, with RenRen Restaurants (copy of Playfish’s Restaurant City) and Happy Pet (copy of Playfish’s Pet Society). Developers will need more resources, serious teams and finances, to develop the next hit game.

China’s consolidation will be on a miniature scale compared to Facebook though. In fact, it has already begun: Five Minutes, developers of Happy Farm, scored 3.5m USD from Draper Fisher Jurvetson on Dec. 1. And Rekoo, developers of Sunshine Farm, received 1.5m USD from Infinity Venture Partners. China will follow Facebook developers here: expect more consolidation in 2010.

Top 10 Social Games in China

Are Chinese More Addicted than Westerners?

The Top 10 Social Games in China (a new report released by BloggerInsight) details the exploding social gaming market in China and analyzes how game companies can compete to succeed.

Parking Wars received a lot of attention for its initial success but has since been outpaced. Happy Farm hit next and still continues its mainstream popularity, now reaching 27m DAU in China and basically matching FarmVille’s 29m DAU on Facebook. China’s enthusiasm for social games at least matches and arguably exceeds that seen on Facebook.

China’s social games are similar to those on Facebook in terms of themes: the top 10 includes farming, aquarium, pet, and restaurant games. However, further analysis yields some unique characteristics in terms of the developer industry, competitiveness, and popularity.

#1 Happy Farm

It’s hard to overstate Happy Farm’s popularity. In addition to the real deal, there are countless copycats and countless games have adopted the addictive mechanics. Chinese versions are more competitive than their Western counterparts: they allow users to steal and add worms and weeds to friends’ farms.

Pages

Categories

- English

- Game Analysis

- game developers

- Publishers

- Social Networks

- Top Social Games

- Uncategorized

- Virtual Currency

Blogroll

Archive

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

Meta

- Log in

- RSS

- Comments RSS