Qzone, “the largest social network in China,” and Tencent’s other SNS (QQ Campus and Xiaoyou), are failures for three reasons:

- Squandered Opportunity: Chinese internet giant Tencent was enviously positioned to dominate social networking, but blew its chance. QQ Campus failed. Xiaoyou is far behind the competition. Qzone does not reach any new demographics.

- The Site’s Design and Features are Lousy: The Qzone website is an unintuitive eyesore. Its applications are of poor quality and frequently inaccessible.

- Is Qzone Really No. 1? Tencent’s claim of 305 million active users is highly suspect; even its classification as an SNS is questionable. Its competitors are encroaching upon its core user base of young teens.

Does this mean Tencent will soon collapse? Absolutely not.

Guest Blogger: Zhou Hao is the Founder of Winzone, which developed the browser game “Dark Agreement”(黑暗契约), which is now in Open Beta. Zhou Hao has four years of experience in the gaming industry, built a payment system that allows users to pay cash at Internet cafes in exchange for virtual goods, and is an expert blogger on BloggerInsight.com.

Guest Blogger: Zhou Hao is the Founder of Winzone, which developed the browser game “Dark Agreement”(黑暗契约), which is now in Open Beta. Zhou Hao has four years of experience in the gaming industry, built a payment system that allows users to pay cash at Internet cafes in exchange for virtual goods, and is an expert blogger on BloggerInsight.com.

“Happy Farm” is exploding in China and the developer Five Minutes raised USD 3.5 million from DFJ (Draper Fisher Jurvetson). It begs the question: how can developers capitalize on the growth of social games in China?

Social games are a blessing for Chinese social networks. The revenue model for social and web games is proven. The alliance of gaming and advertising will generate the majority of income on social networks. Tencent's Qzone now proudly says, “No, we don’t display any ads from third parties. We use all our advertising to promote our own games!"

But this does not mean that all Chinese social game developers will benefit from these trends. To move from individuals or small teams to serious and profitable companies, developers will have to overcome three significant obstacles.

1. Standardize Social Games; Creativity Carries High Risk

1. Standardize Social Games; Creativity Carries High Risk

In China, web games are now part of a long industry chain. On the one hand, this is due to China’s enormous population (which brings countless young game players); on the other hand, it benefits from its successful industrialization. You can create a profitable web game as long as you have the following elements: various mature components and designs; fashionable graphics; and effective promotion channels. A little creativity in the details helps, but it can even be done without any creativity at all.

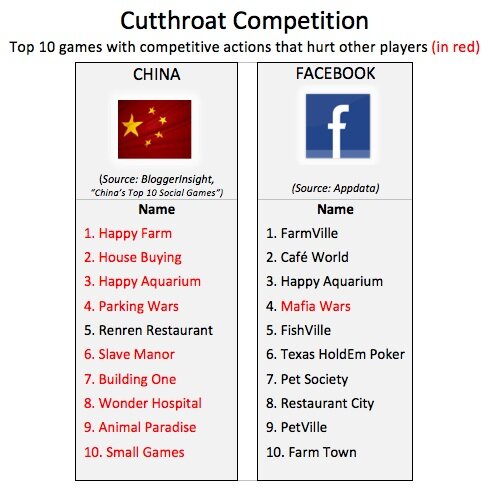

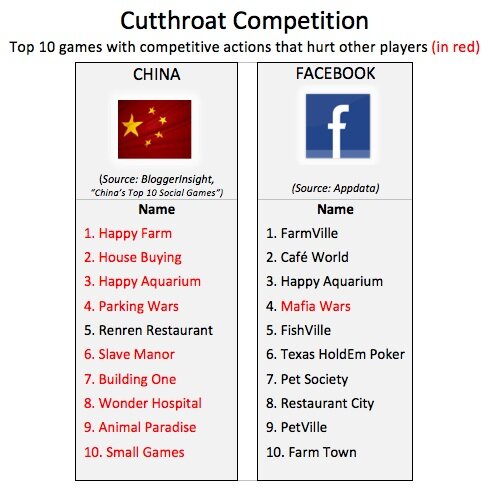

The Chinese government seeks a harmonious society. But it’s Facebook’s social games that are cooperative, while China’s closer resemble the Ultimate Fighting Championships.

9x as Competitive as Facebook?

Of China’s top 10 social games, 9 feature competitive actions that hurt other players (see graphic); the one exception is Renren Restaurant, an exact copy of Playfish’s Restaurant City on Facebook. Of Facebook’s top 10 games, only 1 features competitive actions. Chinese players cherish intense competition.

High-Margin Virtual Goods are Generating Very Real Profits

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The “Copy-to-China” label grossly underestimates the power and ingenuity of China’s internet ventures.

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The “Copy-to-China” label grossly underestimates the power and ingenuity of China’s internet ventures.

Identical Western replicas do not work (there is a reason why no large multinational internet business is a leader here). Instead, local companies are innovating to serve the Chinese market better, creating products and services that appeal to the needs of the consumer. This is also true of other Asian markets, and the region is now a global leader in virtual goods. So much so that the businesses in Silicon Valley and elsewhere are starting to take notice.

For the unbelievers, there are enticing examples of the rewards to be had. Internet heavyweight Tencent recorded revenues of USD 1 billion, at a profit margin above 40 per cent, by selling virtual goods across its multiple online platforms for RMB 10 (RMB 1 = approx. USD 0.14) at a time. Home to China’s most popular instant messenger QQ, Q-Zone social network, and related game sites, it is one of a number of domestic internet sites making a very real profit from something “virtual”.

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The “Copy-to-China” label grossly underestimates the power and ingenuity of China’s internet ventures.

Chinese technology companies have a reputation for lacking innovation and original products. Yet upon closer inspection the industry is brimming with ideas. Despite the fact that Taobao resembles eBay, Baidu searches like Google, and RenRen looks very similar to Facebook, these businesses are not simply knockoffs. The “Copy-to-China” label grossly underestimates the power and ingenuity of China’s internet ventures.