Copying is not the future of social games, unless you’re a Chinese social network

Though copying of both foreign-made and Chinese-made games is rampant in China’s social games industry today, that’s not what will drive the industry forward.

Though copying of both foreign-made and Chinese-made games is rampant in China’s social games industry today, that’s not what will drive the industry forward.

Liu Jian, chief operating officer of Oak Pacific Interactive, owners of the popular RenRen social network, stated, “Copying cannot be the future model for social game developers, unless you’re Tencent.”

That barb, rare at a Chinese conference like the recent ChinaJoy event, prompted a round of applause. The issue of copying is a common one in game industry history, with the likes of Zynga, Electronic Arts, and Activision Blizzard being blasted for it at some point or other.

PopCap Games China: Widely Pirated, But Still Hunting for Treasure

In June 2008, VentureBeat wrote: “The good thing is that PopCap’s games are well known in China. The bad news is that most retail versions are pirated.”

In June 2008, VentureBeat wrote: “The good thing is that PopCap’s games are well known in China. The bad news is that most retail versions are pirated.”

1.5 years later those words still ring true, but PopCap remains upbeat. PopCap is a patient pioneer: “PopCap prioritizes taking the time to get it right – whether that’s building a new game or approaching a new market. We’re investing in China as a market for the long term, we’re not looking for short term gains,” said Giordano Contestabile, Senior Director of Business Development for the Asia/Pacific, in a recent interview with China Social Games. On Twitter:

PopCap has two advantages in China: 1) its games are already wildly popular; and 2) its games are family friendly, suitable for the China market. PopCap’s big disadvantage is that its primary monetization model, “try and buy” downloads, is a loser in pirate-infested China. The real challenge in China is developing a new business model, not new games.

Popular with Chinese Pirates

“When I meet someone in China and introduce my work, I often hear, ‘Ohh, my grandma, mom, and I all play your games.’ Possibly 100 million people play Zuma in China, but we’ve sold virtually none of the copies,” said Mr. Contestabile.

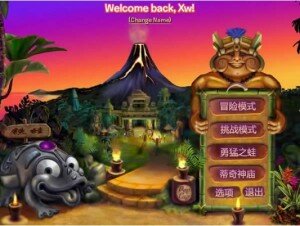

PopCap’s “Plants vs. Zombies” (Chinese: 植物大战僵尸), a charming cross of Tower Defense and Happy Farm, is another smash hit in China. The recently released title costs 20 USD and is not officially sold in China, but the pirated copy is available for free from a number of major Chinese download sites. The translated Chinese text is so professionally integrated into the game that I first believed it to be a genuine Chinese edition by PopCap (it’s not).

Pages

Categories

- English

- Game Analysis

- game developers

- Publishers

- Social Networks

- Top Social Games

- Uncategorized

- Virtual Currency

Blogroll

Archive

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

Meta

- Log in

- RSS

- Comments RSS