PopCap Games China: Widely Pirated, But Still Hunting for Treasure

In June 2008, VentureBeat wrote: “The good thing is that PopCap’s games are well known in China. The bad news is that most retail versions are pirated.”

In June 2008, VentureBeat wrote: “The good thing is that PopCap’s games are well known in China. The bad news is that most retail versions are pirated.”

1.5 years later those words still ring true, but PopCap remains upbeat. PopCap is a patient pioneer: “PopCap prioritizes taking the time to get it right – whether that’s building a new game or approaching a new market. We’re investing in China as a market for the long term, we’re not looking for short term gains,” said Giordano Contestabile, Senior Director of Business Development for the Asia/Pacific, in a recent interview with China Social Games. On Twitter:

PopCap has two advantages in China: 1) its games are already wildly popular; and 2) its games are family friendly, suitable for the China market. PopCap’s big disadvantage is that its primary monetization model, “try and buy” downloads, is a loser in pirate-infested China. The real challenge in China is developing a new business model, not new games.

Popular with Chinese Pirates

“When I meet someone in China and introduce my work, I often hear, ‘Ohh, my grandma, mom, and I all play your games.’ Possibly 100 million people play Zuma in China, but we’ve sold virtually none of the copies,” said Mr. Contestabile.

PopCap’s “Plants vs. Zombies” (Chinese: 植物大战僵尸), a charming cross of Tower Defense and Happy Farm, is another smash hit in China. The recently released title costs 20 USD and is not officially sold in China, but the pirated copy is available for free from a number of major Chinese download sites. The translated Chinese text is so professionally integrated into the game that I first believed it to be a genuine Chinese edition by PopCap (it’s not).

“Plants vs. Zombies” even inspired a real-life re-enactment by university students in Harbin, China. On RenRen, one of China’s top social networks, the game has the 14th largest fan group with 620,000+ users. It features the original song, “There’s a Zombie on Your Lawn.” PopCap has an extremely devoted following of pirates in China!

PopCap has resigned itself to piracy and moved on: “It’s clear that whining about piracy is not going to be the way for us to build a business in Asia,” said James Gwertzman, Head of Asia/Pacific. Instead, PopCap’s challenge is to convert the popularity of our games into profit.

Green Games for China

PopCap’s has one additional advantage: its casual games are all “green.” Game content is subject to strict regulations in China, and PopCap, as a foreign developer, must be extra cautious.

PopCap’s games are puzzle or casual games with cute cartoon graphics. Where most Tower Defense games have machine guns mowing down monsters (see: the iPhone hit FieldRunners), “Plants vs. Zombies” has flowers lobbing green balls at adorable zombies that stagger, leap, and even dance Michael Jackson’s “Thriller.”

A Patient Pioneer

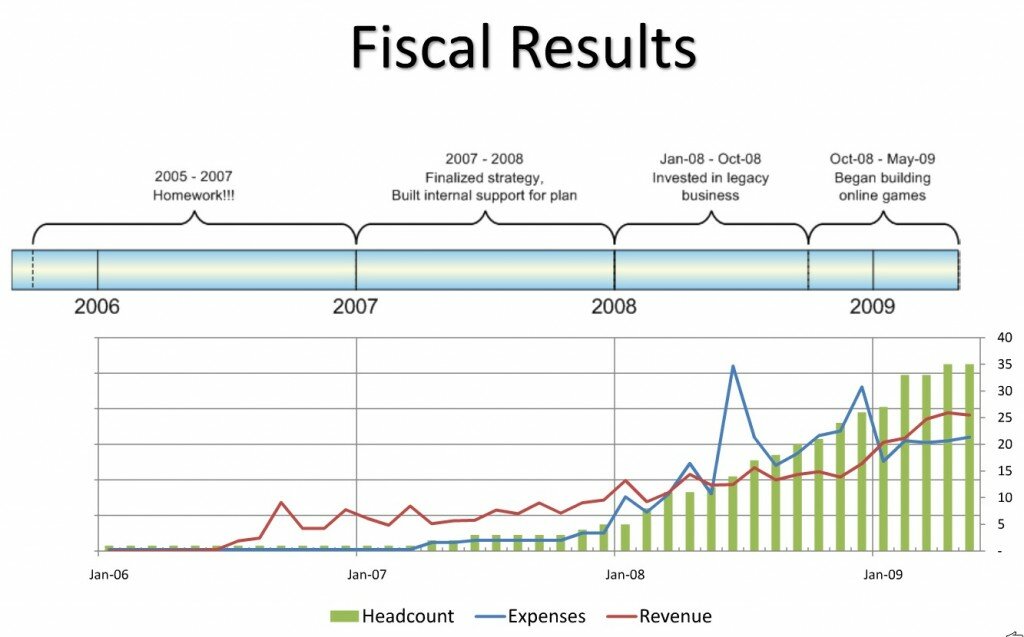

PopCap has extraordinary patience with China. Mr. Gwertzman, head of Asia-Pacific, spent 2 years doing “homework” and it was almost 3 years before he made his first China hire. Virtually no revenues are coming from China, even though Shanghai is the Asia-Pacific headquarters, with 60 staff.

But PopCap Asia-Pacific is careful not to drain the coffers of global headquarters in Seattle: it’s slightly revenue positive (see slide 27, PopCap's first year in China), thanks to earnings in the rest of the region, particularly Japan and Australia. Games are distributed on a variety of platforms, including PC, Mac, mobile, console, iPod and even in-flight entertainment and TV sets. PopCap is the first Western casual games company to open a full-fledged operation in the Asia-Pacific region.

Testing the Waters

PopCap wants to be anywhere and everywhere that people play in China, but is biding its time to get there. It will eventually pursue a range of distribution options in China: social networks, mobile, internet café promotion, and its own online gaming platform.

But both partnerships and regulations are tricky to navigate in China (see: World of Warcraft’s nightmare). “PopCap is all about taking the time to make sure we do things right,” said Mr. Contestabile. “This is as much a regulatory environment as a product concern.”

PopCap has launched two cautious experiments. The first was a “try and buy” download site. An official Chinese partner obtained the necessary government licenses and launched a site with trials of the Chinese versions available for free and the complete games available for 9.9 RMB (about 1.50 USD). Unsurprisingly, this model has not succeeded, as the pirated download price in China is “0.00.”

The second experiment was the launch of “Bejeweled Blitz” on RenRen. The game is the most popular foreign-developed SNS game in China (to my knowledge), with 350,000 installs and 60,000 daily active users. But that’s more a reflection of the lack of penetration by foreign developers to-date than a reflection of PopCap’s success.

But “Bejeweled Blitz” is a cautious experiment that has no monetization component. It’s still about testing distribution partners and building a relationship with the RenRen social network.

The real test is selling virtual goods, the most successful monetization model for casual games in China. That will require a PopCap to shift from a product company to a service provider.

Developing a business model for China is challenging. Mr. Contestabile stated:

“We need to find the right product, right partner, and right approach. The Chinese social gaming space is still very young, and not yet generating significant revenue. One of the issues is the lack of adoption of open platforms by the social networks themselves, which is impeding the creation of a social ecosystem and stunting growth. In my opinion this will change, in the medium if not in the short term.”

PopCap will wait until the time is right.

Kai Lukoff is an analyst at BloggerInsight and an editor on China Social Games. Follow Kai on Twitter

Pages

Categories

- English

- Game Analysis

- game developers

- Publishers

- Social Networks

- Top Social Games

- Uncategorized

- Virtual Currency

Blogroll

Archive

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

Meta

- Log in

- RSS

- Comments RSS