China’s Tencent: $1.8 billion in 2009 revenues—what Facebook could learn

Originally posted at VentureBeat

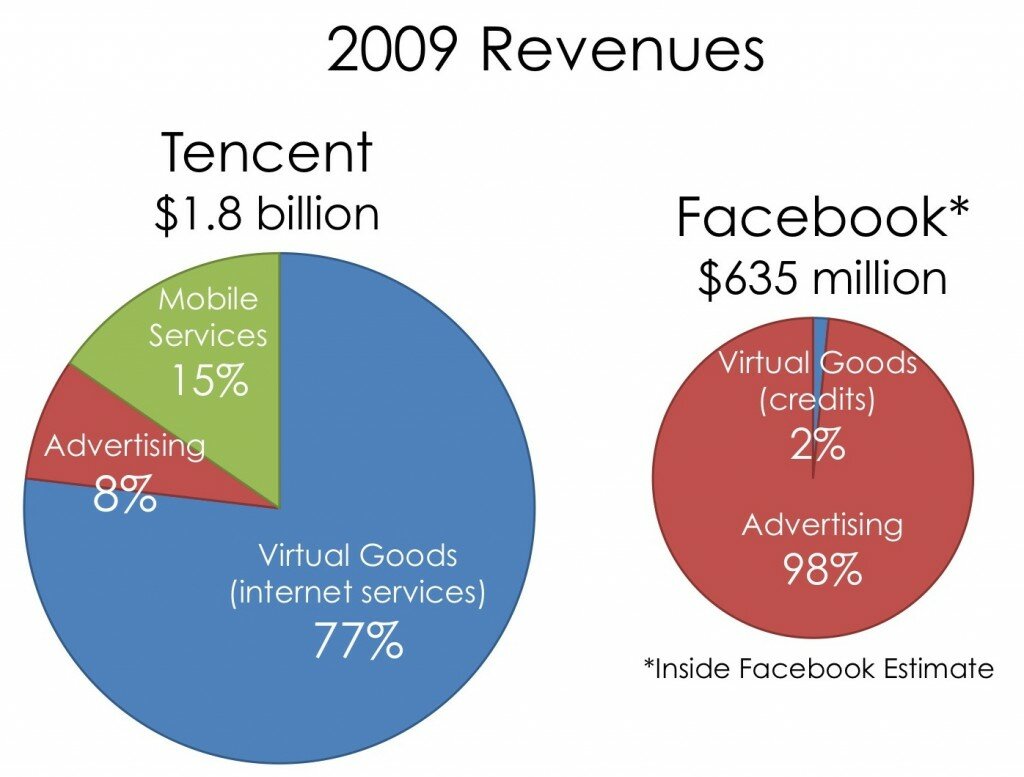

Tencent, a Chinese internet giant in instant messaging, social networks, and mobile, posted $1.8 billion in 2009 revenues, an increase of 74% from a year ago. For the record, that’s about three times Facebook’s in 2009 revenues.

Tencent’s flagship product, QQ Messenger (with a cute penguin logo), is the first introduction to the internet for most Chinese teens. It claims a whopping 523 million active users. Tencent then cross-promotes its other online offerings: QQ Show, QQ Game, QQ Music, QQ Pets, and its social network, Qzone.

Tencent is the undisputed world leader in micropayments. Each QQ service is connected to a “diamond membership” of a different color, that offers free and exclusive virtual goods. For instance, the “red diamond” membership helps you dress up your avatar for face-offs against other online fashionistas in QQ Show. About 10% of Tencent’s active users pay for such memberships, which cost around $1.50 per month. Over 75% of total revenues come from these “internet value-added services,” which grew 94% in 2009.

By comparison, Facebook generated under 2% of revenues from virtual goods according to an estimate from , though that number should rise with the full-fledged introduction of Facebook Credits in 2010. Facebook could learn from Tencent that monthly memberships work better than relying solely upon one-off purchases of credits.

By comparison, Facebook generated under 2% of revenues from virtual goods according to an estimate from , though that number should rise with the full-fledged introduction of Facebook Credits in 2010. Facebook could learn from Tencent that monthly memberships work better than relying solely upon one-off purchases of credits.

Tencent also probed international waters in 2009, including the Facebook platform. It launched a puzzle game, called Treasure Hunter, as a “market research project” to test the Facebook market for synchronous casual games.

Richard Peng, vice-president of corporate development at Tencent, comments, “Tencent is expanding globally, but we are being very cautious. We want to do this the right way, using proper planning and methodology, and we are circumspect about making big mistakes that could kill our business. Because of our cultural sensitivity and sophistication, we are starting off in places that are culturally very close to China – such as Vietnam and Southeast Asia. Once we develop a certain level of experience there, we’ll see about entering the U.S.”

There are however indications that Tencent is losing its innovative edge. It spotted the social networking trend early, but failed to expand beyond its core demographic of teens, a long-standing objective for the company. Instead, its competitors, social networks Kaixin001, RenRen, and 51.com, are starting to encroach upon its territory.

Benjamin Joffe, CEO of internet market research firm +8*, told BloggerInsight: “Tencent is definitely not the best in terms of products or innovation - similar to Zynga in that sense - but their ability to deliver a ‘good enough’ mass market service and integrating it within their ecosystem is impressive.”

Kai Lukoff is an analyst at BloggerInsight and an editor on China Social Games. Follow Kai on Twitter

Pages

Categories

- English

- Game Analysis

- game developers

- Publishers

- Social Networks

- Top Social Games

- Uncategorized

- Virtual Currency

Blogroll

Archive

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

Meta

- Log in

- RSS

- Comments RSS